In a few earlier blogs, I introduced novel foods designed by students for their graduation. One was dedicated to vinegar-based foods, another had a more general nature. The inventors were typically students of food science.

Chinese universities have not only continued these innovative activities, but have combined it with Chinese innate entrepreneurial instinct. A number of agricultural universities and colleges have developed novel foods and have started commercialising these themselves. An important driving force behind these commercial activities is the popularity of the TikTok (Douyin) platform, on which students can advertise their products through direct broadcasting.

In this post, I will introduce a number of novel foods developed and marketed by students and professors of various Chinese universities.

South China Agricultural University

According to the official introduction of South China Agricultural University, in the 1930s, the Agricultural College of Lingnan University, the predecessor of Huanong, had a dairy farm with the scale of one to two hundred cows. This laid the basis for their dairy specialisation. Later, the research field was focussed on the production and development of yogurt. In 1997, Huanong established the Dairy Factory of South China Agricultural University and officially started selling yogurt to the outside world.

Compared with yoghurt on the market, Huanong yoghurt is fresh and contains fewer additives. Its raw materials are fresh milk, bacteria and sugar. Huanong yoghurt’s sales slogan is: our yoghurt is like a meal cooked by our own family. It may not taste as attractive as restaurants, but we believe that simplicity can do the trick’.

Southwest University

Southwest Konjac is a product developed by Southwest University, founded in 2012. The story says that in 1979, Professor Liu Peiying of Southern Agricultural University discovered that Japan purchased large volumes of konjac from Sichuan and Yunnan provinces, and initiated research into konjac. The university registered its own konjac brand, and founded the KGM Functional Food R&D Centre to develop functional products, special medicinal foods, medicines, beauty products, etc., all with Konjac as raw material.

Southwest is offering more konjac-based products.

Konjac strips. You can prepare them as a low calorie alternative for glass noodles.

Konjac sticks; Marketed as ‘not so sweet’.

Yunnan Agricultural University

When talking about Yunnan, people usually think of fresh flower cake. In fact, the fresh flower jelly developed by Yunnan Agricultural University and the Yunnan Highland Agricultural Industry Research Institute is also very special. At present, the fresh flower jelly series includes four flavours: rose, jasmine, chrysanthemum and osmanthus. There are fresh flowers in each jelly.

Hunan Agricultural University

Fantianwa is a brand of spicy dough sticks, a traditional product of Hunan that has gain national popularity during the past couple of years, developed by Hunan Agricultural University. In addition to being the leading brand, these spicy strips are also unique in taste. Their sales slogan in: ‘it makes people feel like they can “go to heaven” after eating’. Fantianwa has also created a toplevel clean room, becoming the first spicy stick enterprise in Hunan with HACCP certification and ISO9001 quality management system certification.

Xinjiang Shihezi University

Shennei brand carrot juice is not only alive in the memory of Xinjiang children, but also makes some people who don’t like to eat carrots change their minds about this vegetable. In 1996, Shihezi University set up the Shennei Xinjiang Product Research and Development Centre, and carrot juice is one of its products adapted to local conditions. Shennei carrot juice is made from a local variey of carrot, which is produced in the north slope of Tianshan Mountain, and is freshly pressed by cell wall breaking technology.

There are several more of these university-developed novel foods. The above my personal pick, but I will be most happy to guide those who want to know more, like partenering with one of this high-quality institutions.

Guangdong Academy of Agricultural Sciences

Pure mulberry juice. This product does not contain any additive.

Nanjing Agricultural University

Zuochuan Pure maize porridge. Maize is the only ingredient on the label.

China Agricultural University

Four types of honey; all without any additives.

Ningxia Academy of Agricultural Sciences

Pure goji juice; No thickeners, sugar or water added.

China Academy of Tropical Agricultural Sciences

Nama chocolate; this product fits in with the ‘raw food’ trend in China. Does not contain transfatty acid.

Guangxi Academy of Agricultural Sciences

Mazhongcai river snail noodles; a modern presentation of the traditional food from Liuzhou in Guangxi.

Heilongjiang University

Master Ling sauerkraut; not the German stuff but traditional Chinese style.

China Academy of Agricultural Sciences

Shizhuang oat meal; Chinese are gradually getting into oat meal and this product is marketed as healthy.

Longguan pure green tea; grown in the Thousand Island Lake near Hangzhou.

High folic acid sweet corn; contains 300 microgram of folic acid per knob.

Fujian Agricultural University

Peanut crisps; just a healthy snack.

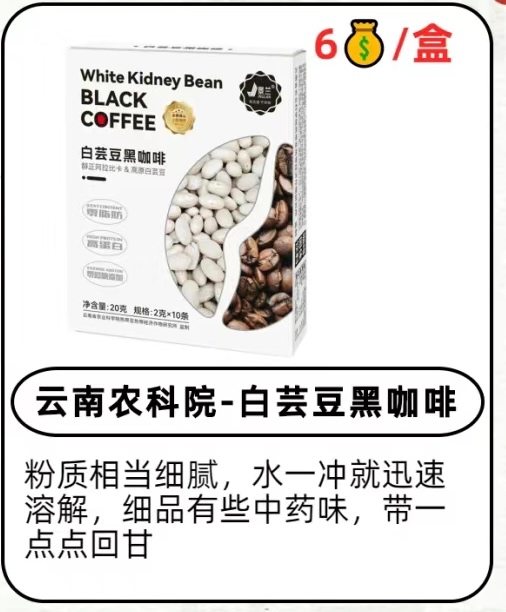

Yunnan Academy of Agricultural Sciences

White bean coffee; combining the fat burning action of white bean extract with the mental boost of coffee. I visited their stand on the Pu’er Coffee Fair in January 2024.

Nanjing Agricultural University

Purple sweet potato congee; for an alternative breakfast. The ad promise that it is good for losing weight.

More products

Here is additional information added Feb. 2024

Konjac strings

Southwest University (Chongqing) has developed konjac strings, a healthy snack food. Other products include: konjac noodles and konjac bread.

Coloured guoba

This is a product from Northwest Agriculture & Forrest University (Shaanxi); made from coloured potatoes.

Chickpea powder

It is an easy guess that this product has been developed by an institution in Xinjiang: Xinjiang Agricultural Research Institute. The powder can be used in various recipes.

Prof Huang’s roasted chicken

A professor of Nanjing Agricultural University is trying to imitate Colonel Sanders.

Yangzhou University (Jiangsu) has developed a range of honeys, including one from loquat and robinia flowers.

Rose sauce

This ingredient can be added to tea, milk, bread, etc., and is a product of Yunnan Agricultural University.

Buffalo Milk

Central China Agricultural University (Wuhan) is behind this product. An interesting detail is that they transliterate ‘buffalo’ as bafulai, which means ‘eight (types of) luck are coming’.

There are more products from this news source, so contact us for a more complete report on leading Chinese universities in food and beverage development. Eurasia Consult has a database of research conducted at a large number of Chinese universities and research institutes

Peter Peverelli is active in and with China since 1975 and regularly travels to the remotest corners of that vast nation. He is a co-author of a major book introducing the cultural drivers behind China’s economic success.