Introduction

The industrial chain of tomato paste production mainly includes tomato planting, harvesting, processing, packaging and sales. Its upstream industries include tomato planting, pesticides, fertilizers, agricultural machinery, etc.; The midstream link is the production and processing of tomato paste, including cleaning, crushing, deseeding, concentration, seasoning and other steps, which require advanced processing equipment and technical support; The tomato paste produced by midstream production enterprises is packaged and sold through downstream sales channels, and is widely used in ready-to-eat fast food, pizza, snack food, canned food, beverages/juices, soups and other fields. As a commonly used condiment, tomato paste is widely used in Western cuisine. In Chinese cooking, it is mainly used to prepare sweet and sour flavours, such as squirrel mandarin fish, sweet and sour pork, etc.

Nutrition

Tomato paste contains lycopene, B vitamins, dietary fibre, minerals, protein and natural pectin, etc. Compared with fresh tomatoes, the nutrients in tomato sauce are more easily absorbed by the body.

Industry

In recent years, the scale of China’s tomato paste market has continued to expand, and the market capacity has been growing. However, at present, China’s tomato paste market is mainly occupied by leading enterprises, which have become industry leaders by virtue of their brand advantages, production scale and sales channels. However, some small and medium-sized enterprises compete with large enterprises through cooperation with farmers, production cost advantages, and flexible marketing strategies. In addition, some cross-industry enterprises have also entered the ketchup market, and these enterprises usually have strong financial strength and advanced production technology, which has a certain impact on the market competition pattern.

Ketchup

Ketchup is tomato paste with various added ingredients. In fact, ketchup is derived from the pronunciation of the Chinese term qiezhi (tomato juice) in southern dialects, spoken by Chinese in Southeast Asian countries. Ketchup is mainly divided into basic ketchup, Italian ketchup, jam-based ketchup, chili ketchup, sweet ketchup, sugar-free/low-sugar ketchup, organic or natural ketchup. The most common type of base ketchup is made from fresh or processed tomatoes, onions, garlic, herbs, spices, etc. It is often a versatile sauce that can be used to make a variety of dishes.

Industrial chain

The industrial chain of tomato paste production mainly includes tomato planting, harvesting, processing, packaging, sales and other links, and its upstream industries mainly include tomato planting, pesticides, fertilizers, agricultural machinery, etc., and tomato planting enterprises mainly provide raw materials for the midstream, so its output and quality will directly affect the quality and cost of tomato paste. The midstream link is the production and processing of tomato paste, including cleaning, crushing, deseeding, concentration, seasoning and other steps, which require advanced processing equipment and technical support. Leading enterprises are: COFCO Sugar Holdings Co., Ltd., Xinjiang Guannong Co., Ltd., Zhongji Health Industry Co., Ltd., Xinjiang Tianye Co., Ltd.

Tomato growing

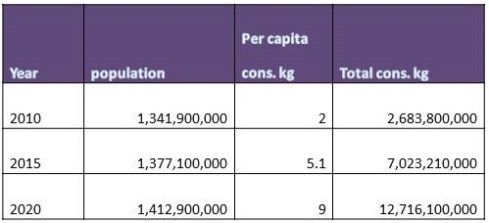

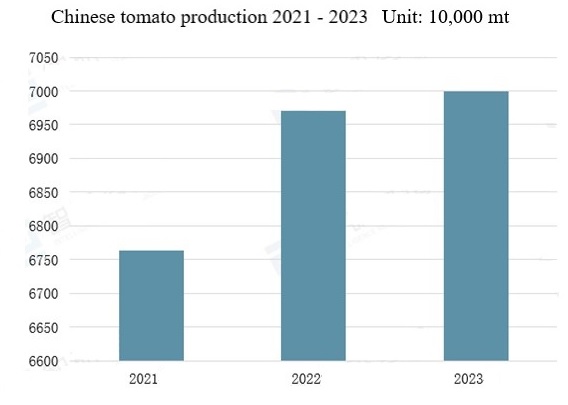

In recent years, China’s tomato planting area has stabilized between 1.2 and 1.3 mln hectares, ranking the fourth largest vegetable variety in the country and has become an important part of the agricultural industry. The planting area is an important factor affecting the yield of tomatoes, so its stability will ensure the yield of tomatoes to a certain extent. The data shows that in China’s tomato production continued to rise during the past few years reaching more than 70 mln mt.

Xinjiang is blessed with unique natural conditions, including long sunlight hours, large temperature difference between day and night, dry climate and little rainfall. Xinjiang tomatoes have a high content of red pigment, high soluble solids, a high yield, as well as less pests and diseases. These characteristics greatly reduce the occurrence of fruit cracking and mouldy rot, and improve the overall quality of tomatoes. Therefore, Xinjiang is the main area of tomato cultivation in China. From the perspective of development history, Xinjiang first began to plant tomatoes on a large scale after the founding of the People’s Republic of China. After the first tomato paste production line was built in Xinjiang in 1984, the tomato industry began to embark on a fast track. From a national perspective, Xinjiang’s tomato production accounts for more than 80% of the country’s total.

Unstable

A good development of tomato production and marketing requires the a stable foundation for different parties in the value chain such as breeders, seedling dealers, growers, vegetable wholesalers, and consumers in the whole industry chain. In tomato production, wholesalers dominate market prices, so producers are at a disadvantage, unable to obtain stable and considerable income The low and unstable income have accelerated the transfer and loss of growers to other industries. The data show that from January 2022 to May 2024, the wholesale price of tomatoes in China has shown a downward trend. However, from the perspective of the production of tomato sauce in the midstream, the decline in the wholesale price of tomatoes will directly reduce the production costs of tomato sauce manufacturers, which is conducive to the rapid development of tomato sauce production enterprises.

Paste production

In recent years, the scale of China’s tomato sauce market has been growing. At present, China’s tomato sauce market is dominated by a few leading enterprises, which have become industry leaders by virtue of their brand advantages, production scale and sales channels. However, some small and medium-sized enterprises compete with large enterprises through cooperation with farmers, production cost advantages, and flexible marketing strategies. In addition, some cross-industry enterprises have also entered the tomato paste market, and these enterprises usually have strong financial strength and advanced production technology, which is beginning to impact the market competition pattern.

Related posts:

Tomatoes in the Chinese kitchen and even more for export

Peter Peverelli is active in and with China since 1975 and regularly travels to the remotest corners of that vast nation. He is a co-author of a major book introducing the cultural drivers behind China’s economic success. Peter has been involved with the Chinese food and beverage industries since 1985.