In Shanghai, bread has become an indispensable part of young people’s lives, whether it’s gathering with friends, exploring every corner of the city on a City Walk, or at various social events, bread has become a must-have food companion.

With the popularity of the Internet and changes in lifestyle, young people in Shanghai are revolutionizing the way they buy bread. From queuing up in physical stores to buying bread online, this shift not only reflects the change in consumption patterns, but also drives the innovation and development of the entire baking industry.

Bread has always been loved by the public as a quick and delicious breakfast and snack, and more and more young people are no longer satisfied with buying bread in traditional offline bakeries, but choose to buy bread online.

Metropolis

In the fast-paced metropolis of Shanghai, traditional bakeries seem to be losing favour with younger consumers. According to Winshang Big Data, although Shanghai has more than 1,300 bakery shops, ranking first in the country, young people are more inclined to buy bread online.

Left-overs

Driven by the wave of digitalization, online shopping has become an important part of modern life. For busy young people in Shanghai, buying bread online is not only convenient and fast, but also enjoys more discounts and choices. Recently, a method of food sales called ‘leftover blind boxes’ has quietly emerged, which is highly sought after by young people because it is labelled as money-saving, fun, and environmentally friendly. In addition, bakery accounts on social media platforms have become a new front to attract customers. Through the release of activities such as ‘Discount Blind Box’ and ‘Free Tasting’, it has successfully attracted the attention and participation of a large number of young users. This seems to be the next step after the appearance of good boxes in previous years.

Buying bread is crazier than buying clothes

In Shanghai, the fashion capital, young people are just as crazy about food. Compared to traditional bakeries, online bakeries are more diverse in styles and flavours. Shanghai’s bakeries have a variety of cake styles, so many that they may be more than you can imagine: from classic baguettes to creative matcha breads, from healthy breads with low sugar and fat to rich sandwiches. From classic French desserts to innovative varieties infused with Chinese flavours, Shanghai’s bakeries cater to every taste. There is a wide range of styles to make people dazzled.

Blind boxes

In recent years, the blind box economy has risen rapidly in China, and major businesses have launched blind box products to attract consumers. Blind boxes, as an emerging marketing method, have found its place in the food industry. The bread blind box packages launched by major merchants not only increase the fun of shopping, but also provide consumers with more opportunities to try unknown flavours. And under this trend, the bread industry is not to be outdone by launching the bread blind box. These mystery boxes often contain a variety of random styles of bread, making every opening full of surprises. Consumers don’t know exactly what styles and flavours of bread they will get when they buy it, and this sense of mystery and anticipation makes young people want to stop. For young consumers who are looking for novelty and curiosity, this way of buying has an irresistible appeal.

Recommended other posts:

Bread in China – from snack to staple, though still for the young urban

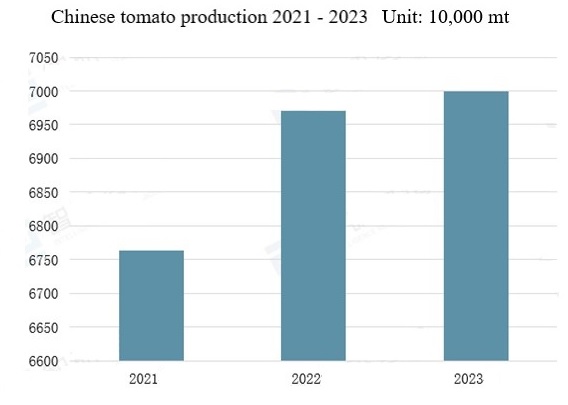

Some Chinese bakery statistics

Uncle and Aunty Xiong, French bakers in Beijing

Peter Peverelli is active in and with China since 1975 and regularly travels to the remotest corners of that vast nation. He is a co-author of a major book introducing the cultural drivers behind China’s economic success. Peter has been involved with the Chinese food and beverage industries since 1985.