Undoubtedly, Coca Cola is the top-selling soft drink globally. Introduced in 1886, it has become a household name in over 200 countries. However, its immense popularity has also made it the most imitated drink worldwide. We’re all familiar with the rivalry between Coca Cola and Pepsi.

Introduction to China

Coca Cola arrived in China at a time when Chinese were eager to experience the delightful products of Western fast food imagination they had read about but yet to taste. KFC’s hot wings were an instant hit, but the introduction of Coca Cola in China didn’t go as smoothly. Initially, Chinese consumers found the taste reminiscent of medicine. Indeed, the typical cola flavour bears a resemblance to some traditional Chinese medicinal (TCM) potions. Interestingly, both colas were perceived as medicines from the late 19th century onwards. In fact, some Chinese food authorities were hesitant to make the beverage accessible to consumers of all ages, concerned about potential harm to children. However, these initial obstacles soon vanished, and Coca Cola gained immense popularity in China, just like anywhere else.

Imitations

It was only a matter of time before the Chinese imitation industry began churning out one local cola after another. Most of these attempts failed and were short-lived, while a few managed to gain traction and survive for some time. The leading imitation is Future Cola by Wahaha Group, a prominent beverage manufacturer headquartered in Hangzhou, Zhejiang. Wahaha began producing its own cola in 1998. Feichang Kele (literally ‘Extraordinary Cola,’ translated into English as Future Cola) closely replicated the colors and other features of Coca Cola. Leveraging Wahaha’s extensive distribution network, Future Cola dominates rural China and its second- and third-tier cities. In 2003, its sales amounted to a staggering 620 million liters.

Wahaha’s advertisements adopt a nationalistic tone. For instance, their copy promotes Future Cola as “Chinese people’s own cola,” encouraging consumers to choose it over Coke or Pepsi. This aligns perfectly with the nationalist trend (guochao) of the 2020s. Future Cola’s focus on rural areas contributed to its high penetration at lower costs. Additionally, it leveraged celebrity advertising to enhance its brand image. Its penetration pricing made it an affordable alternative to its rivals, especially in more price-sensitive rural regions.

A major brand is Tianfu Cola, produced in Chongqing, has gained a new herbal flavour thanks to the cooperation of a domestic time-honoured brand. Tianfu Cola has a history of over 40 years and is a taste memory for several generations of Chinese people. Because of the herbal ingredients in the drink, some consumers even used to consider the cola as a ‘remedy’ for colds back in the day. Its secret lay in a special formula, which drew on traditional Chinese medicine and added several herbs, such as white peony root and Chinese angelica. Upon its launch in 1981, Tianfu Cola quickly won the favour of consumers, with annual sales reaching over 200,000 metric tons, accounting for about 75% of China’s cola consumption.

In 2021, Tianfu Cola upgraded its packaging design, brand positioning and marketing strategies, and added more healthy herbal plants to create a unique Chinese cola.

In the remainder of this post, I aim to analyse various local cola brands across different categories.

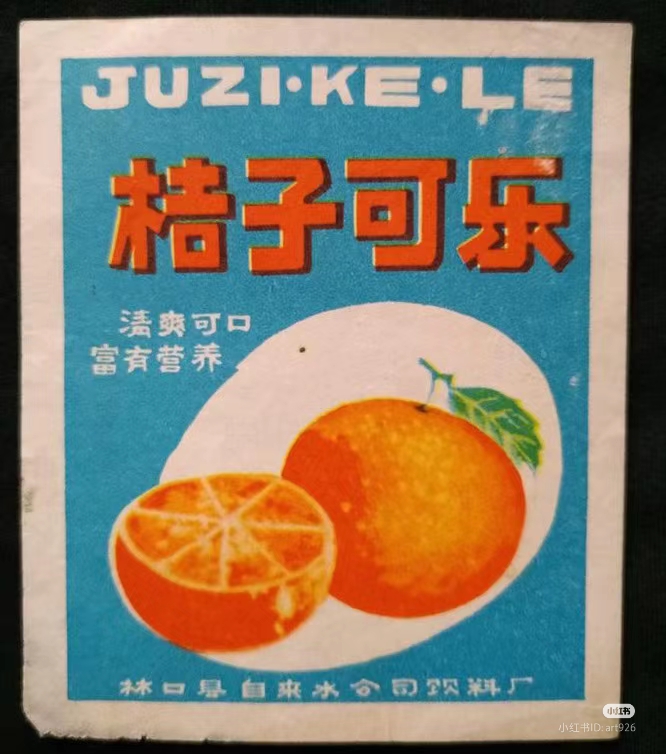

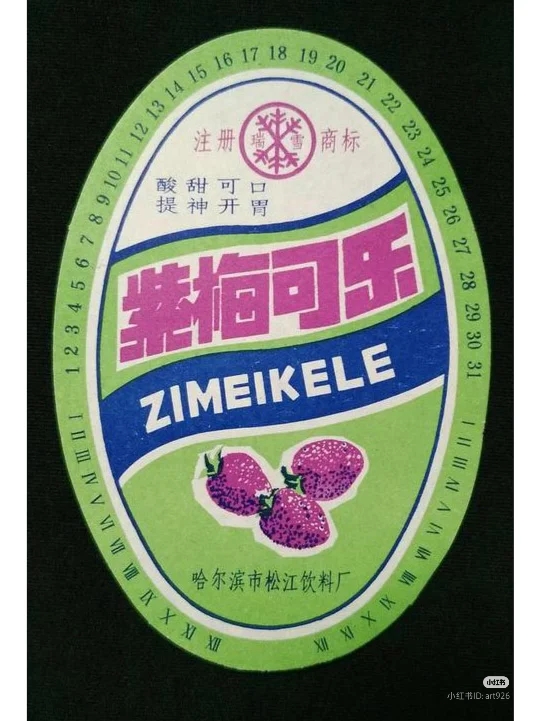

Fruit: To address the medicinal taste issue, several manufacturers introduced fruity flavours to their colas. Examples include orange cola, blackcurrant cola, and purple plum cola.

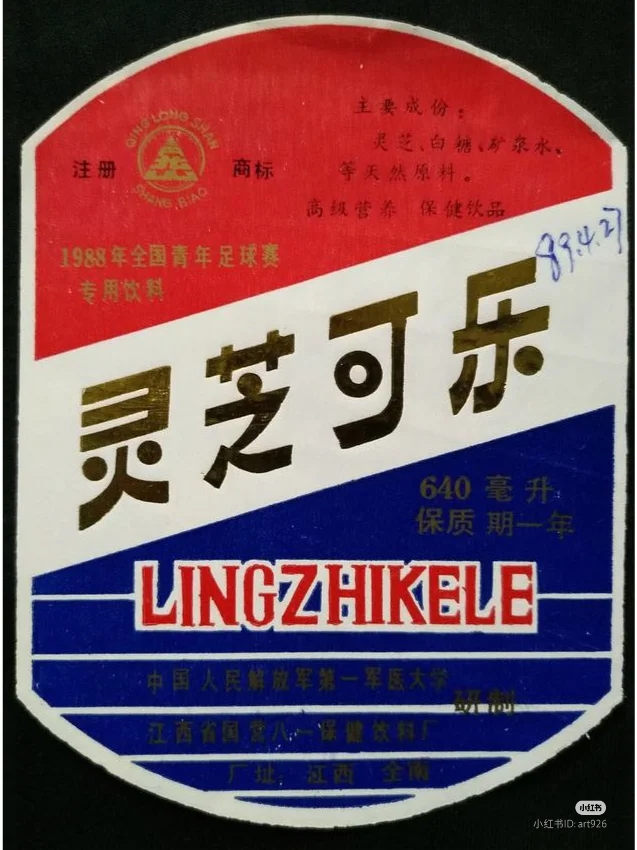

Medicine: Other producers capitalised on the medicinal aspect and incorporated TCM herbs into their colas, positioning them as health beverages. For instance, Lingzhi Cola (lingzhi – reishi – the ganoderma fungus), gingko cola, and maifanshi cola (maifanshi is a stone rich in minerals) are among these products.

Nobility: Adding a touch of nobility to your drink can elevate its perceived high-end appeal. Brands like Empress Cola, High Fortune Cola, High Heaven Cola, and of course, the top-tier Future Cola exemplify this concept.

Famous location: Some cola brands associate themselves with specific locations, adding a sense of place and identity to their products. Qingdao, a prominent port city in Shandong, is renowned for its Tsingtao Beer and Laoshan Mineral Water, which is also used to produce Tsingtao Beer. The region once produced its own Qingdao Cola and Laoshan Cola, but Qingdao Cola was not produced by the brewery but rather used that name to entice consumers.

A hint of Heineken

My favourite imitation cola has never achieved significant success, but the makers certainly put in their best effort. The brand name was Kexi Kele, which literally translates to ‘Happy Cola.’ However, this name subtly hints at Xili Beer, the Chinese name for Heineken Beer. A mere glance at the label reveals the striking resemblance. Kexi Kele was produced by a small brewery in Harbin, the capital of Heilongjiang. In today’s China, that combination of brand name and label would likely face challenges, but I can appreciate the initiative.

Vinegar Cola – a healthy choice (?)

This is a special type of Chinese Cola. It is produced in Shanxi province, where I found during a trip through that province in November 2024. Shanxi is famous for its vinegar, so it is no surprise to find this version of Cola there. Moreover, vinegar beverages like apple vinegar have been in vogue in China since around 2022 as health beverages.

This post does not encompass all Chinese imitation colas. I have compiled a list of 21 different labels, and I don’t exclude the possibility of adding more in the future. So, please keep an eye on this post for any future updates.

Peter Peverelli has been actively involved in and with China since 1975 and frequently travels to the most remote regions of that vast nation. He is a co-author of a significant book that delves into the cultural factors driving China’s economic success. Peter has been involved in the Chinese food and beverage industries since 1985.