Ice wine is originally a German product. Due to global warming, Germany has now been overthrown by Canada as the largest producer. Interest in iced wine is growing worldwide and, as usual, this quickly arouses the interest of Chinese entrepreneurs. I tasted ice wine at a producer in Yunnan province in December 2023.

Ice wine

Ice wine was actually discovered by chance. When you expose grapes to frost for a few nights before harvesting, the fruits dry out. As a result, the sugar content becomes higher. In addition, this delayed harvest also gives free rein to fungi that feed on the sugars and convert them into aromatic substances. That combination of concentration and mould gives the juice and the wine that is made from it the typical aroma of ice wine. Ice wine can be made from different white grapes, but in Canada the Vidal grape is the favourite.

Weixi

A Beijing entrepreneur, a New Zealand winemaker and the local government of Weixi Prefecture in Yunnan Province imported and planted stock of the vidal grape from Canada in Weixi in 2009. This location has been selected as the most suitable for this grape after a long comparative study. The area is located in the subtropical zone, but at 2300 meters above sea level, so that warm sunny days alternate with cold nights, many with sub-zero temperatures, ideal for the production of ice wine.

Grapes

Upon arrival at a local guest house in Tacheng, a village in the Weixi region, we left for the winery located higher on the mountain. From the car we saw fields of vines on both sides of the car. Most of that village’s farmers bred grapes. The grapes were still hanging on the sticks, even though it was already at the end of December, but did not make an attractive impression at first glance. They were shrivelled and closer we also saw white fungal threads. Then arrived at the company.

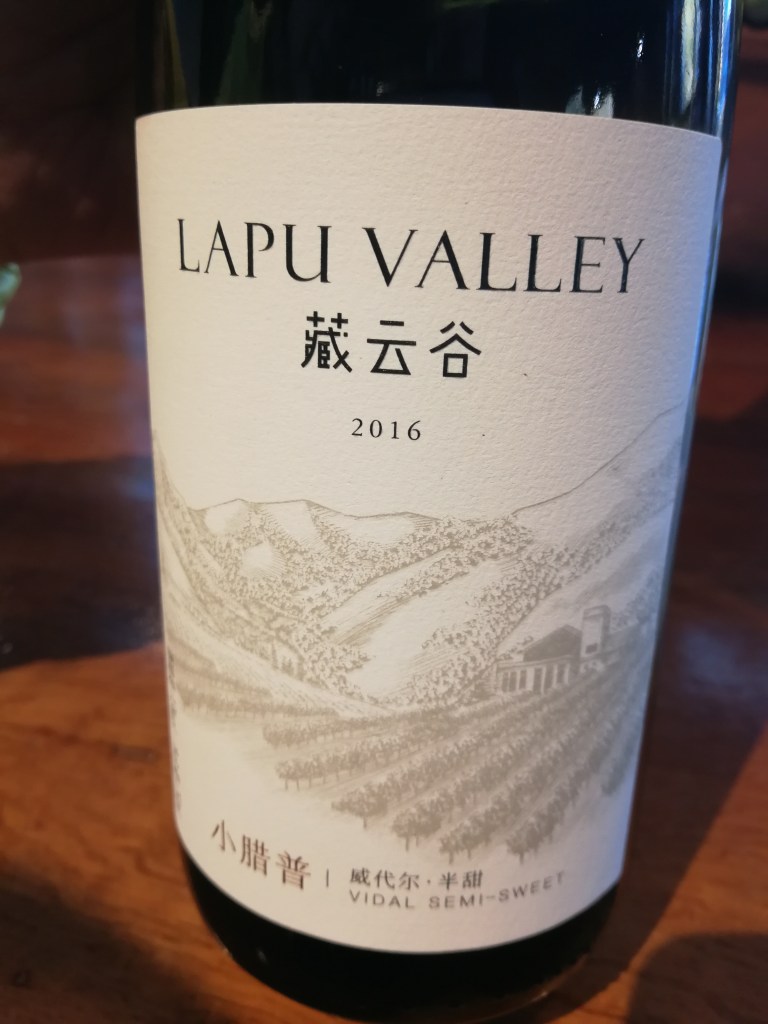

Lapu Valley

It turned out to be a state-of-the-art winery. From the outside it didn’t seem too big, but on the way to the office we saw a hall with shiny stainless steel fermenters and storage vessels; according to the manager imported from Italy. The company is built against a slope so that it is a lot deeper than it seems from the outside. The company is called Lapu Valley Winery, named after the Tibetan name of the river that flows through the valley. Of course, it has also been noted that many wines from countries such as Chile or Australia are called XX Valley. Farmers in the area who have switched to grape cultivation deliver their produce to Lapu Valley, which makes wine from it in a modern way.

Three products

In a special tasting hall we were presented with three wines, as usual in order of intensity: dry, semi-dry and sweet. The dry wine is not the biggest product, but it is the most special. Sweet wines are the usual product made from the Vidal grape. As far as I know, Lapu Valley is the only winery that also produces dry wine from it. The dry wine is remarkably light in taste, but still retains the typical aromas of the Vidal grape. The semi-dry wine is less special, but according to the manager it is most appreciated by Chinese guests. It fits well with a Chinese meal that typically consists of several dishes, which you eat simultaneously. Personally, as a European, I would prefer the dry version. The ice wine is a true revelation. As far as I’m concerned, this one compares with the top brands.

Small volume

It is unlikely that we will see Lapu Valley wines for sale in outside China any time soon. The production is still too small to think of international promotion. They have already won a bronze medal in China. A number of Western restaurants in major cities like Shanghai have purchased wine from Lapu Valley and there is also a buyer in Hong Kong. In order to produce more income, the company also sells its bottling and packaging capacity to other companies. During our visit we saw that the employees were busy bottling a red wine imported in large barrels for a trading house elsewhere in the region.

Peter Peverelli is active in and with China since 1975 and regularly travels to the remotest corners of that vast nation. He is a co-author of a major book introducing the cultural drivers behind China’s economic success